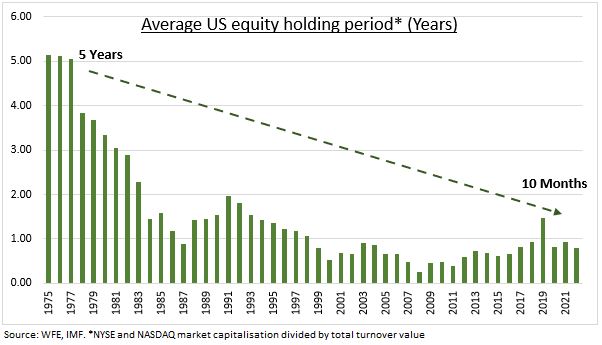

Why Short-Term Trading Can Be Long-Term Stewardship Alex Edmans This was to be my final Economia column, but was not published a

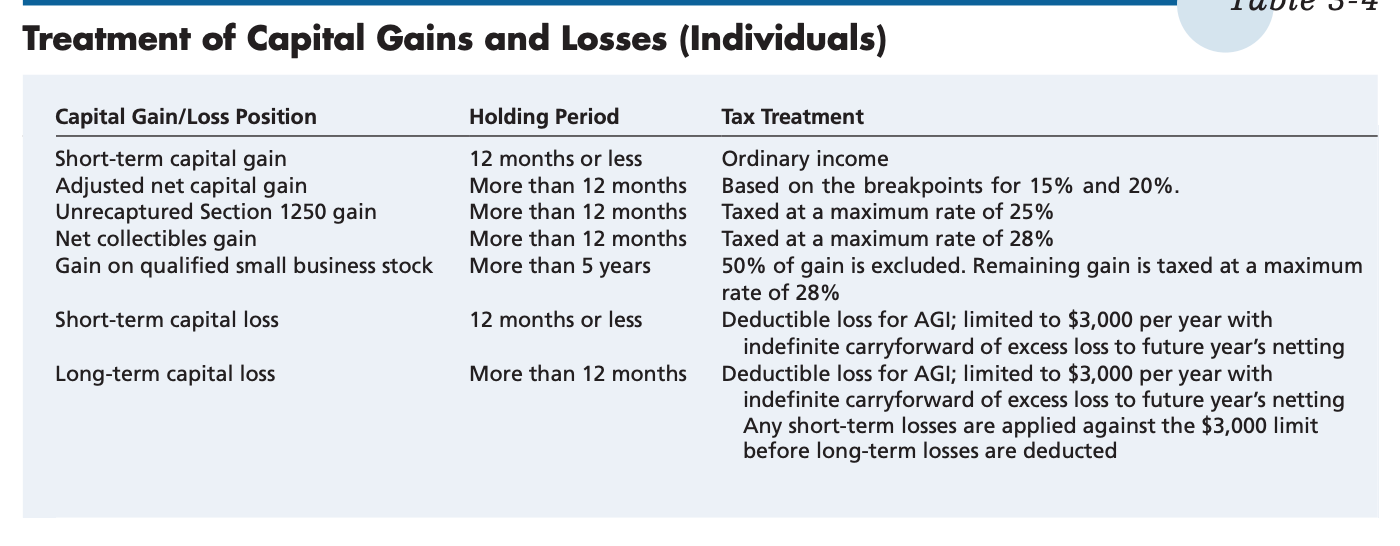

New Holding Period Rules for Carried Interests and the Impact on Upstream Oil and Gas | Bracewell LLP

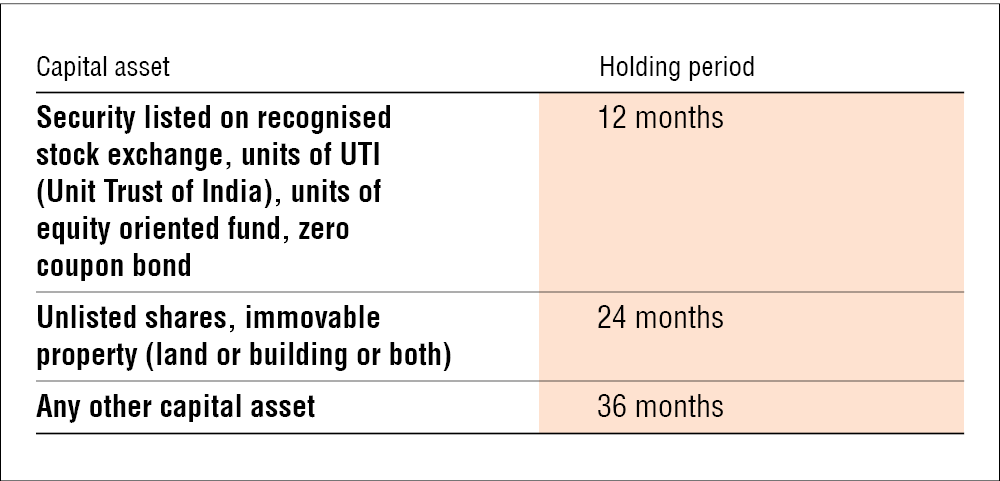

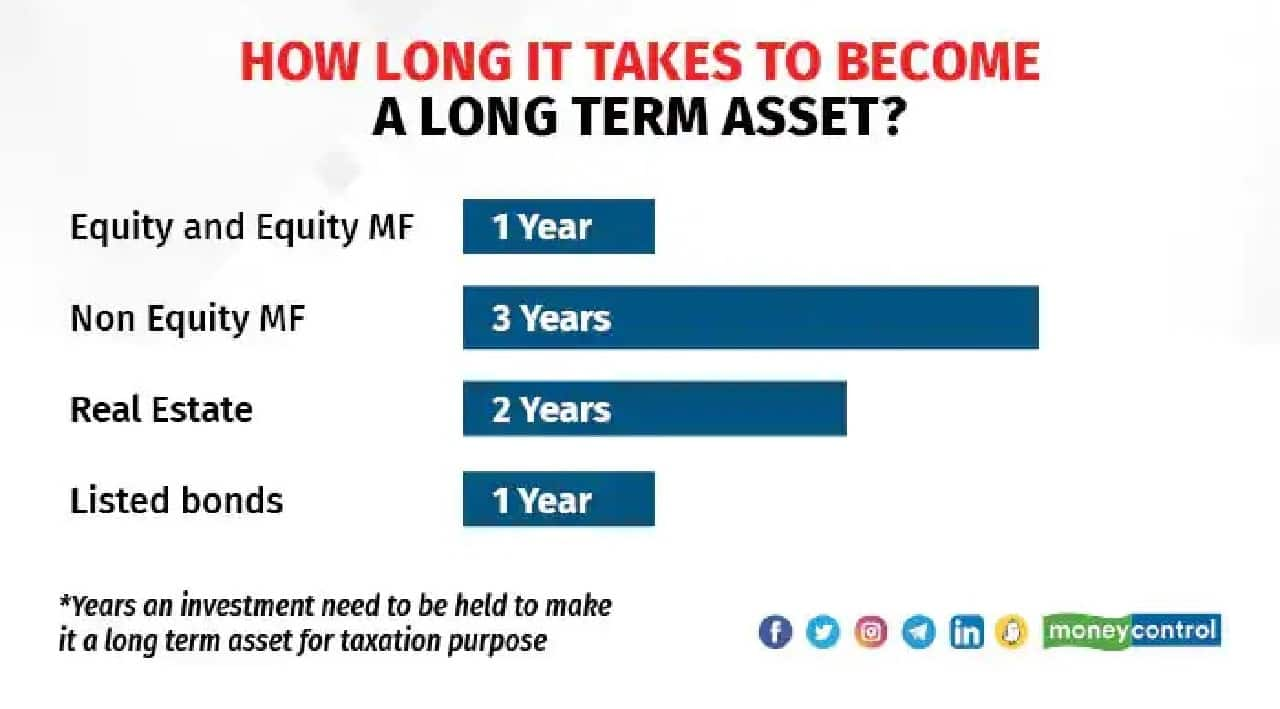

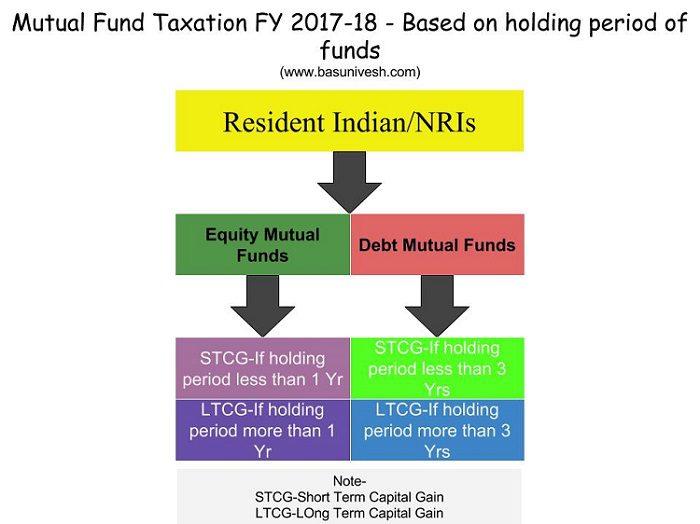

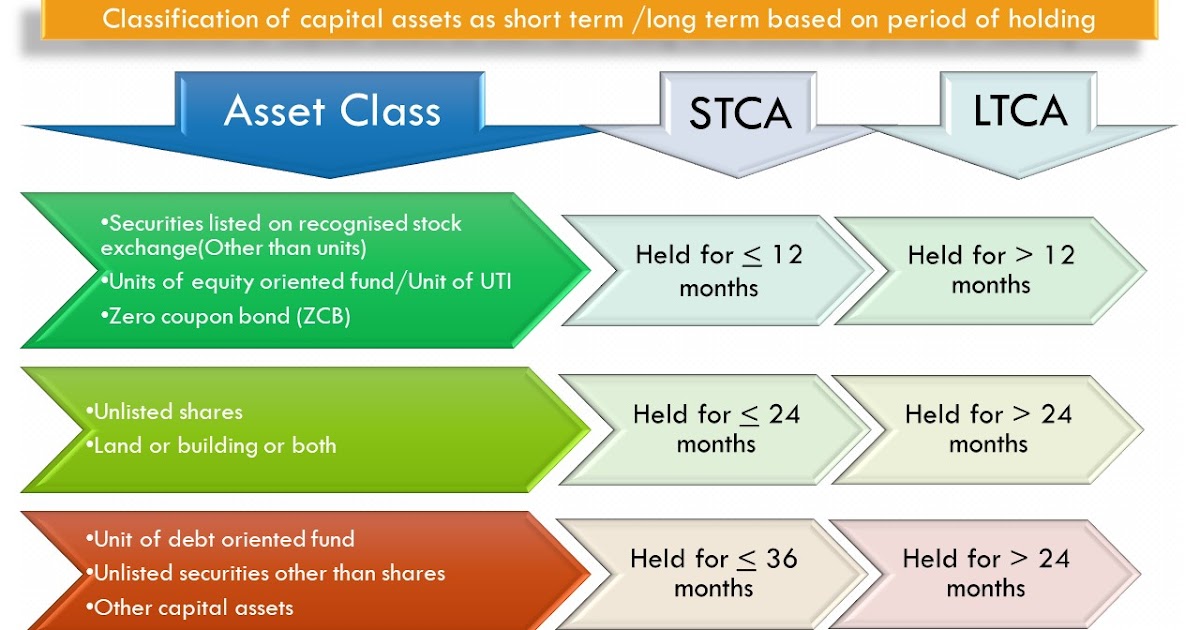

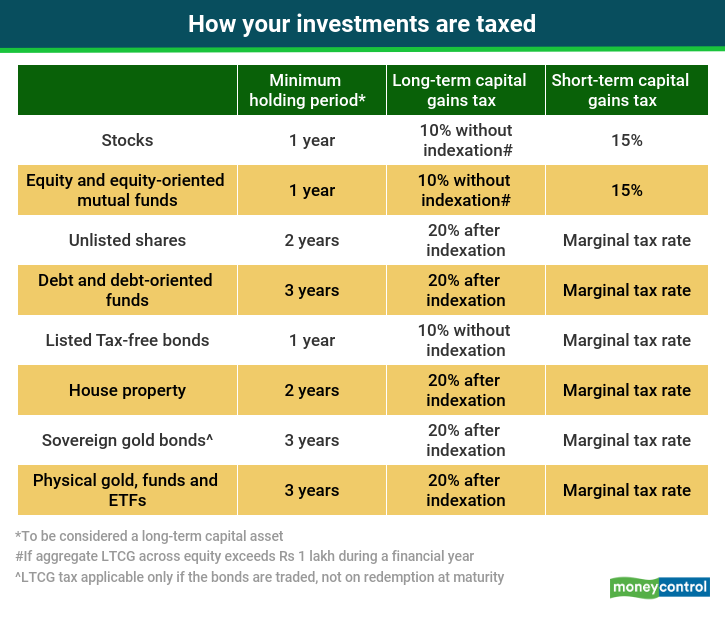

How-to-determine-short-term-long-term -capital-gain-capital-loss-shares-Equity-Debt-mutual-funds-Property-Gold- Holding-period-pic - Certicom

swapnilkabra on Twitter: "🔸Caution: If you book short term loss on your holding and buy the same share the same day again, it will be considered as intraday loss which cannot be

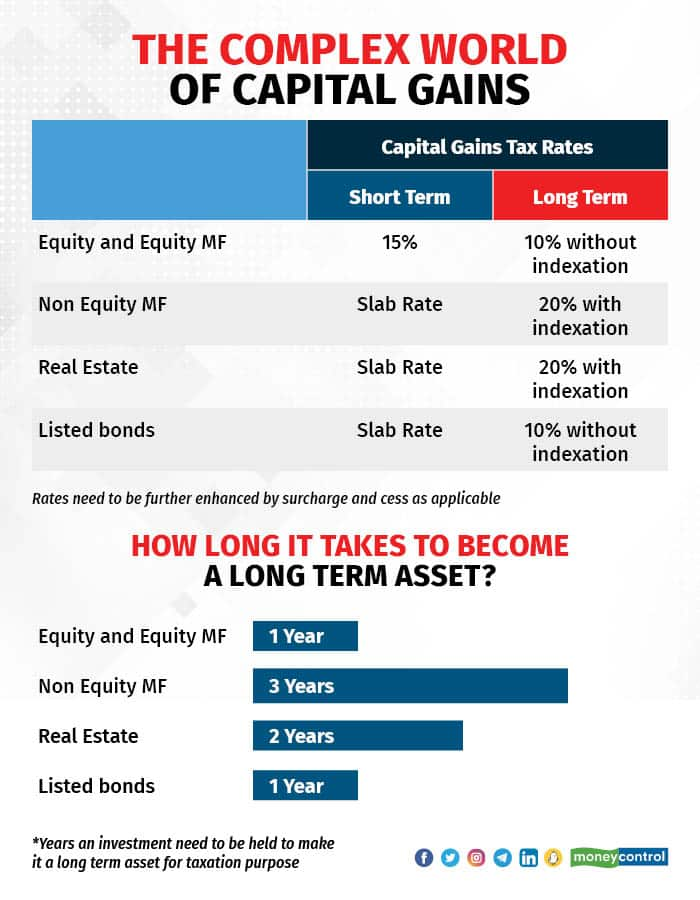

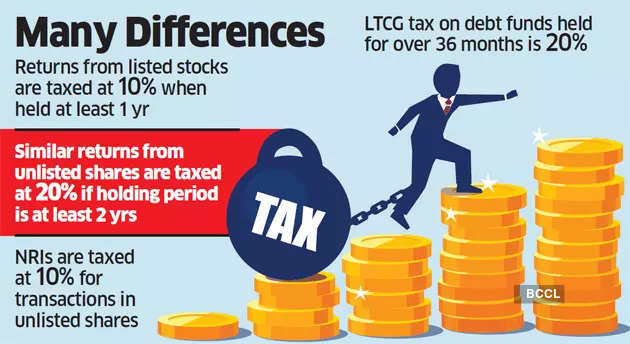

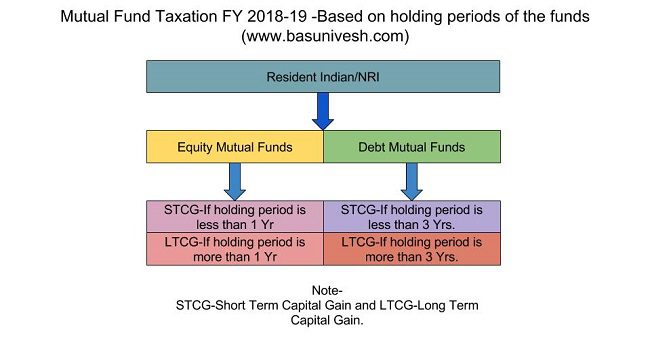

![Long-Term Capital Gain Tax- Simplified [Budget 2018-19] Long-Term Capital Gain Tax- Simplified [Budget 2018-19]](https://www.tradebrains.in/wp-content/uploads/2018/02/Long-Term-Capital-Gain-Tax-Simplified.png)