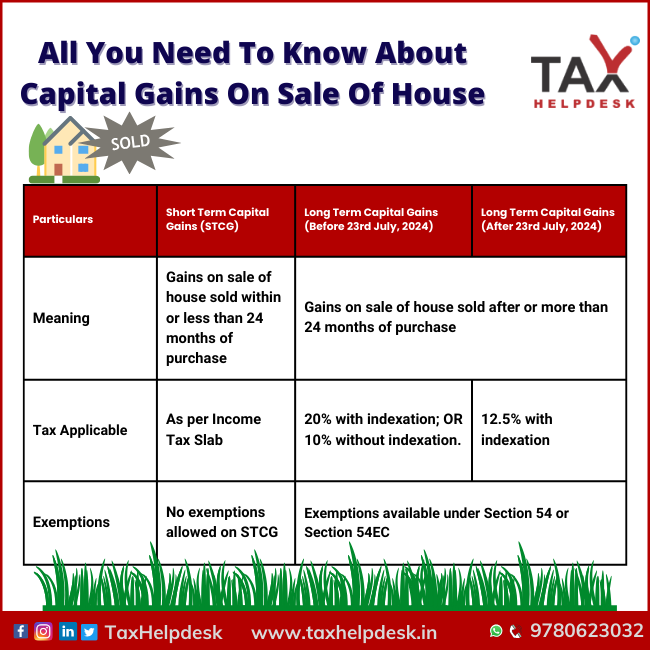

Difference Between Short and Long Term Capital Gains - Compare & Apply Loans & Credit Cards in India- Paisabazaar.com

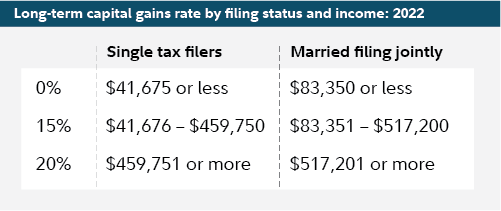

Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

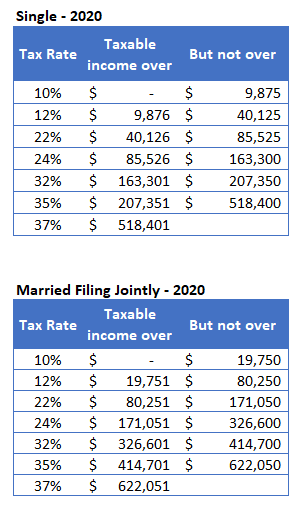

Jim Hilker: Tax Considerations When Exiting Dairy Farming - Department of Agricultural, Food, and Resource Economics

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)